More than $500 million but not over $1 billion More than $250 million but not over $500 million More than $100 million but not over $250 million More than $50 million but not over $100 million More than $25 million but not over $50 million More than $5 million but not over $25 million More than $1 million but not over $5 million More than $500,000 but not over $ 1 million A $10,000 reduction applies to all capital tax calculations (provided that the capital tax cannot be less than $0).Modification: The portion of total business capital directly attributable to stock in a subsidiary that is taxable as a utility within the meaning of the New York City Utility Tax or would have been taxable as an insurance corporation under the former New York City Insurance Corporation Tax

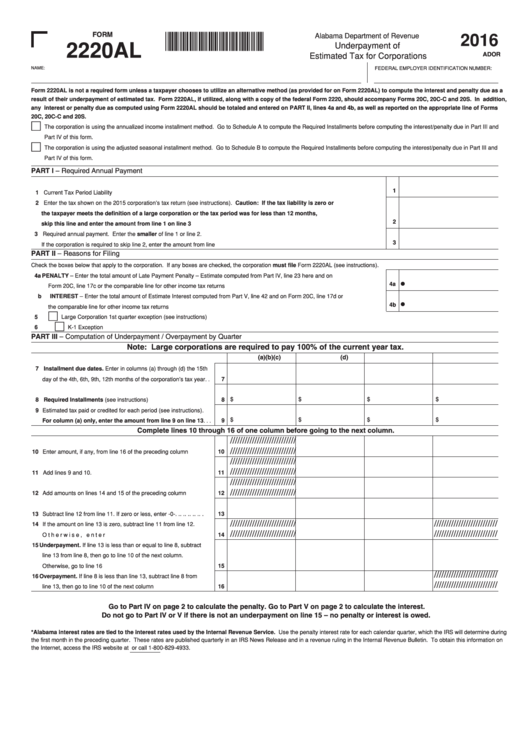

2016 tax extension form corporations code#

Small businesses qualify depending on their level of income.įinancial corporations are corporations, or combined groups that meet the definition set forth in Administrative Code section 11-654(1)(e)(1)(i). Qualified manufacturing corporations must meet certain property and receipts tests.

The tax applies to business income, however, business capital and gross receipts are alternative minimum tax bases It has not elected to be taxable as a domestic corporation and has no effectively connected income for federal income tax purposes.Its activities are limited to investing or trading securities for its own account within the meaning of the federal safe-harbor contained in section 864(b)(2) of the Internal Revenue Code, or.Foreign corporations that do not qualify as doing business in the city under a de minimis activities standard in Administrative Code section 11-653(2).Partnerships and limited liability companies that are characterized as partnerships for federal income tax purposes (but see the Unincorporated Business Tax).Publicly traded partnerships that were subject to the City Unincorporated Business Tax in 1995 and made a one-time election not to be treated as a corporation and, instead, to continue to be subject to the Unincorporated Business Tax for tax years beginning in 1996.S-corporations are exempt from the Business Corporate Tax, but they are still subject to the General Corporation Tax or Banking Corporation Tax The sum of its NYC credit card customers and NYC credit card merchants equals 1,000 or more.Has merchant customer contracts with 1,000 or more merchants located in the City to whom the corporation remitted payments for credit card transactions or.Issued credit cards to 1,000 or more customers who have a NYC mailing address.A corporation is also considered to do business in the City if it:.A corporation may be considered to do business in the City if it is a partner or member in a partnership that does business, employs capital, own or lease property in the City, or maintains an office in the City.Publicly traded partnerships that did not elect out of City corporate taxation in 1996 are also characterized as corporations.Joint stock companies or associations, and.The term corporations includes any entity that is taxable as a corporation for federal tax purposes, by election or otherwise, and so may include:.Corporations that do business, employ capital, or own or lease property, or maintain an office in the city in a corporate or organized capacity must pay this tax.

0 kommentar(er)

0 kommentar(er)